Apple Pay Review - why 4.7 stars?

Compare Pricing

| ITQlick Score: | 90/100 |

|---|---|

| ITQlick Rating: |

|

| Pricing: | 2.2/10 - low cost |

| Category: | Retail & POS -> Apple Pay review |

| Ranking: | Ranked 17 out of 431 Retail & POS systems |

| Company: | Apple |

| Pricing: | starts at $300 per license |

| Typical customers: | Small, medium and large size businesses |

| Platforms: | Cloud |

| Links: | Apple Pay pricing, Apple Pay alternatives |

Shlomi Lavi / updated: Mar 22, 2022

Shlomi Lavi / updated: Mar 22, 2022We publish unbiased reviews. Our opinions are our own and are not influenced by payments from advertisers. This content is reader-supported, which means if you leave your details with us we may earn a commission. Learn why ITQlick is free .

Table of Contents

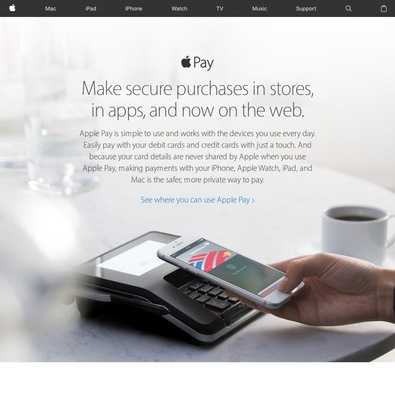

What is Apple Pay?

Apple Pay is a cloud-based Retail and POS software designed to offer a secure and private way to pay for goods and services through iOS apps. The software comes with features such as:- Setup In Seconds: Apple Pay is a breeze to set up. End-users can simply connect their credit or debit card to their iPhone Wallet app.

- Use Apple Cash with Apple Pay: Apple Pay powers Apple Cash, which functions similarly to a debit card and allows users to send and receive money directly from messages. Users can simply add their Apple Cash card to the Wallet app and transfer money to their brunch buddies.

- Protected Personal Data: When sellers make a purchase, Apple Pay employs a device-specific number and a one-of-a-kind transaction code. As a result, the credit card information is never kept on users devices or Apple servers. When payment is made, Apple never shares credit card information with retailers.

- Tap more, Touch less: Apple Pay operates directly from the iPhone of end-users, eliminating the need to touch buttons and terminals, handle cards, and exchange currency. As a result, their hands are cleaner and less likely to take up and transmit germs.

- Your Purchases Stay Private: When users make payments with a debit or credit card, Apple Pay does not save transaction information that can be used to identify them. The information is solely saved for troubleshooting, fraud prevention, and regulatory purposes when Apple Cash is used.

Who is it best for?

The typical customers include the following business size: Small, medium and large size businesses.What is the actual cost?

The cost of license starts at $300 per license. ITQlick pricing score is 2.2 out of 10 (10 is most expensive). Access ITQlick pricing guide for Apple Pay. You can also find here pricing information from Apple Pay's website.Pros

- Apple Pay enables users to pay in-app and in the browser

- Users will experience a seamless experience when using Touch ID or Face ID

- Users can do not have to input any of their business bank information into Apple Pay

- The Card registration process requires a few steps

Cons

- Apple pay does not work very well in all countries

- The software is exclusive to iOS and MacOS enabled hardware

- Not all retail outlets support the software yet

How it stacks up?

Access a head to head analysis of Apple Pay vs alternative software solutions. ITQlick rating

Score

Pricing

License pricing

Functionality

Review

Compare

Apple Pa...

ITQlick rating

4.7/5

Score

90/100

Pricing

2.2/10

License pricing

$300 per license

Functionality

3

Review

Compare

ShopKeep...

ITQlick rating

4.3/5

Score

99/100

Pricing

2.4/10

License pricing

$49 per month

Functionality

11

Review

Compare

NetSuite...

ITQlick rating

3.8/5

Score

96/100

Pricing

7.8/10

License pricing

Pricing not available

Functionality

20

Review

Compare

Rezku

ITQlick rating

4.7/5

Score

96/100

Pricing

2/10

License pricing

$99 per license

Functionality

16

Review

Compare

Revel PO...

ITQlick rating

3.8/5

Score

95/100

Pricing

3.2/10

License pricing

$99 per terminal/month

Functionality

60

Review

Compare

Frequently Asked Questions (FAQs)

Is Apple Pay right for you or your business?

Apple Pay allows consumers to make secure purchases by holding their iPhones over near field communication (NFC) terminals Instead of using cash or cards at the checkout. Touch ID allows users to give all payment and shipping details with a single touch.List of categories

Retail & POS

Bakery POS

Grocery POS

Auditor - Shlomi Lavi

Shlomi Lavi is an entrepreneur and founder of ITQlick.com. He holds a Bachelor of Science (B.Sc.) in Information Systems Engineering from Ben Gurion University in Israel. Shlomi brings 17 years of global IT and IS management experience as a consultant and implementation expert for small, medium and large-sized (global) companies. Shlomi’s goal is to share the best knowledge and news about information systems so you can make smarter buying decisions for your business.